Financial Literacy Basics Every Teenager Should Know

Instructor

Admin

1

Student

enrolled

- Description

- Curriculum

Course Description

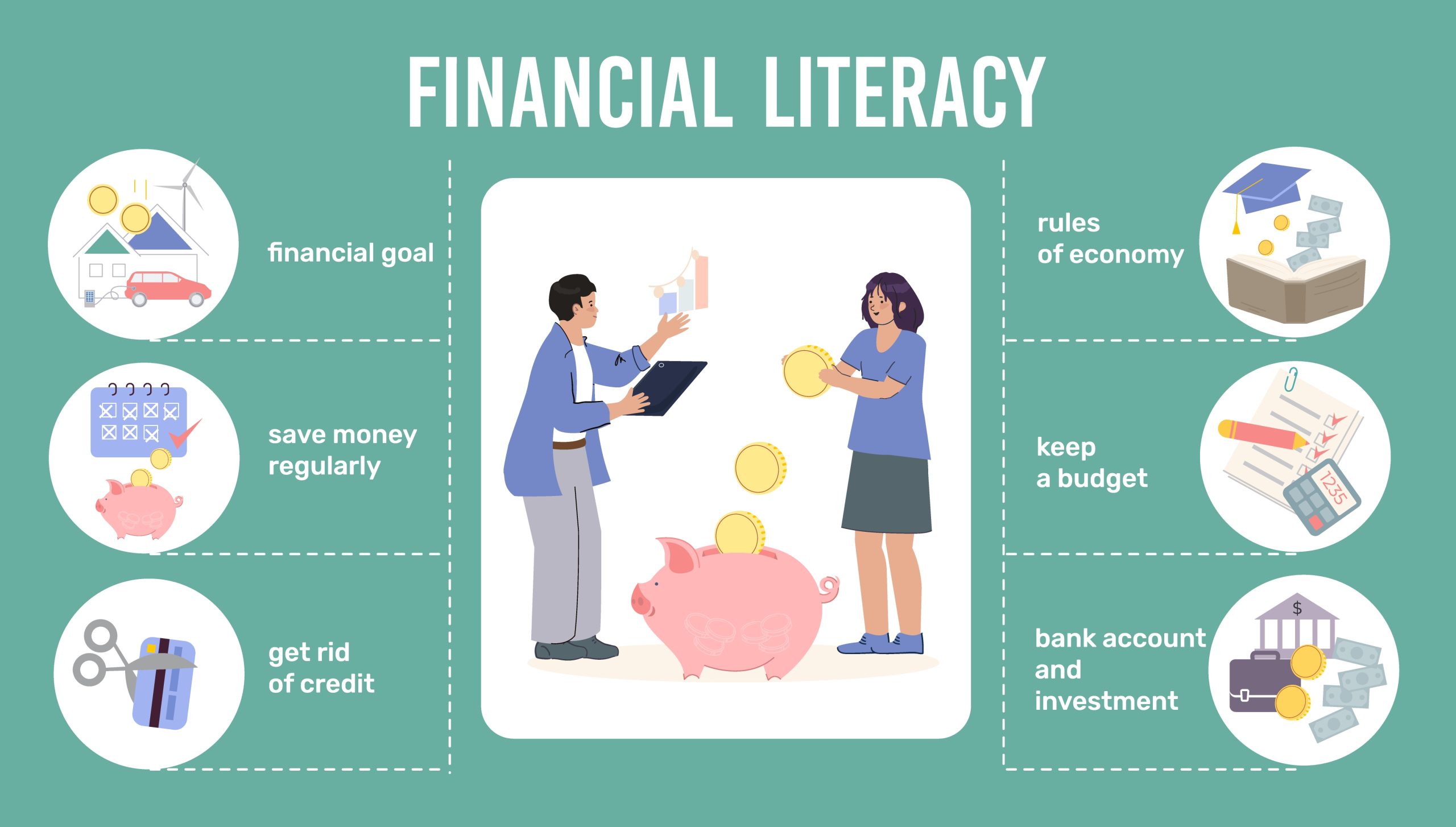

This foundational course introduces teenagers to essential money management skills and financial concepts they’ll need throughout their lives. Students will learn practical strategies for budgeting, saving, and making informed financial decisions while developing a healthy relationship with money. The course covers everything from opening bank accounts and understanding credit to setting financial goals and avoiding common money mistakes. Through real-world scenarios, interactive activities, and hands-on exercises, students will build confidence in handling personal finances and gain the knowledge needed to achieve financial independence as young adults.

Course Objectives

- Introduce fundamental financial concepts – Students will learn key terminology and principles including income, expenses, assets, liabilities, interest, inflation, and the time value of money.

- Develop budgeting and money management skills – Students will master techniques for tracking income and expenses, creating realistic budgets, and using digital tools to manage their finances effectively.

- Build understanding of banking and credit systems – Students will explore different types of bank accounts, learn how credit works, understand credit scores, and discover strategies for building positive credit history.

- Explore investment basics and wealth building – Students will gain introductory knowledge about stocks, bonds, mutual funds, compound interest, and long-term wealth accumulation strategies.

- Promote responsible financial decision-making – Students will develop critical thinking skills to evaluate financial products, avoid predatory lending, and make informed choices about major purchases and financial commitments.

Course Outcomes

- Create and maintain a personal budget – Students will be able to track their income and expenses, allocate funds for different categories, and adjust their spending habits to meet financial goals.

- Navigate banking services confidently – Students will know how to open bank accounts, use ATMs safely, understand account fees, and choose appropriate banking products for their needs.

- Demonstrate knowledge of credit fundamentals – Students will be able to explain how credit scores work, identify factors that affect creditworthiness, and describe strategies for building and maintaining good credit.

- Set and work toward financial goals – Students will be able to establish short-term and long-term financial objectives, create action plans to achieve them, and understand the role of saving and investing in reaching their goals.

- Make informed consumer decisions – Students will be able to comparison shop effectively, identify and avoid financial scams, understand the true cost of debt, and evaluate whether major purchases align with their financial priorities.

Module 1

Module 2